News

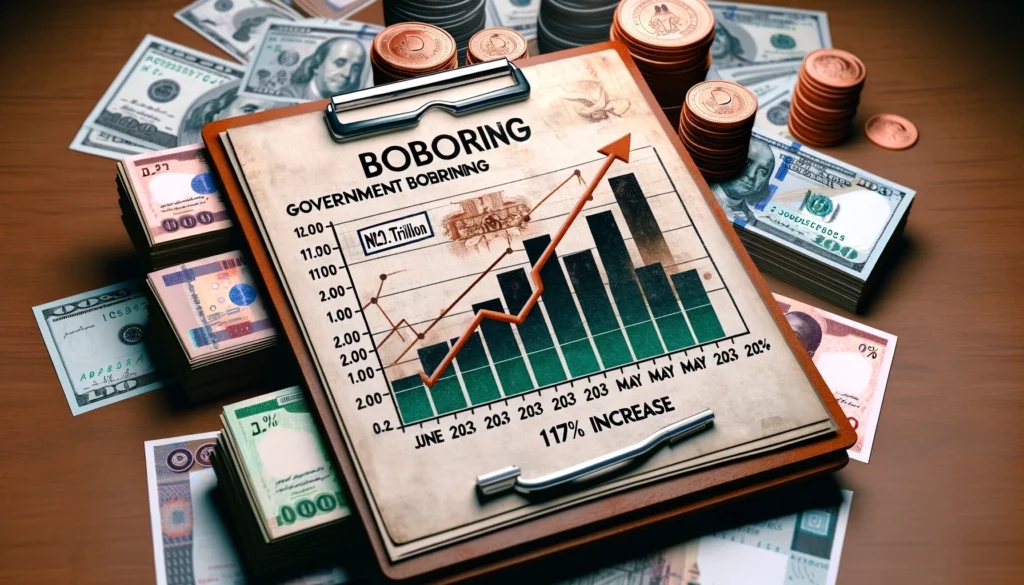

Soaring Borrowing: Tinubu Administration’s N20.1 Trillion Debt Raises Economic Concerns

By Alaro of Nigeria

The Federal Government borrowed N20.1 trillion from domestic investors in President Tinubu’s first year in office, marking a 117% increase from the previous year. This surge has raised alarms about its potential effects on the economy, including increased inflation, higher debt service costs, and elevated borrowing costs for businesses.

Analysts warn that this sharp rise in government borrowing could exacerbate the already high inflation rates, potentially leading to further interest rate hikes by the Central Bank of Nigeria (CBN). This, in turn, would increase borrowing costs for both businesses and individuals.

The Federal Government borrows from domestic investors through the issuance of FGN Bonds, FGN Savings Bonds, and Sukuk Bonds by the Debt Management Office (DMO), as well as Nigeria Treasury Bills (NTBs) issued by the CBN on behalf of the FG.

According to financial data from the DMO and CBN, from June 2023 to May 2024, the government borrowed N20.09 trillion through these instruments, a significant increase from the N9.275 trillion borrowed in the same period the previous year. NTBs accounted for the majority of this increase, making up 66% of the total domestic borrowing during the period.

Borrowing Breakdown

Data from the CBN shows that the FG’s borrowing through NTBs rose by 188% year-on-year (YoY) to N13.235 trillion in the 12 months ending May 2024, up from N4.592 trillion in the previous year. Borrowing through FGN Bond auctions, which comprised 32.8% of total domestic borrowing, rose by 42% YoY to N6.476 trillion from N4.537 trillion. FGN Savings Bonds, making up 1.5% of the total, increased by 116% YoY to N29.17 billion from N16.07 billion.

Interest Rate Hike

The 117% YoY increase in FG’s domestic borrowing was influenced by the high interest rate environment, driven by the CBN’s hikes in the Monetary Policy Rate (MPR). The average MPR rose to 20.32% in the 12 months ending May 2024, up from 16.21% in the previous year. Consequently, the average interest rate on NTBs increased to 9.1% from 4.0%, and the rate on FGN Savings Bonds rose to 17.91% from 10.89%.

Despite the high-interest regime, analysts express concern that the surge in government borrowing is detrimental to the private sector, making business loans more expensive and potentially stifling growth.

Analysts’ Perspectives

Nnamdi Nwizu, Co-Founding Partner at Comercio Partners, noted that increased government borrowing typically leads to more spending, which can drive up demand for goods and inflate prices. He highlighted that higher borrowing costs for the government could crowd out private sector lending, as investors would prefer the safer government securities offering high returns.

Tunde Abidoye, Head of Equity Research at FBN Securities Limited, echoed these concerns, adding that government borrowing could indirectly affect exchange rates and intensify inflationary pressures. He suggested that the CBN might continue raising interest rates to control inflation.

Chinazom Izuorah, Senior Associate at an Investment Brokerage, argued that while higher interest rates on government securities attract more investors, reducing money circulation and thus limiting inflation, they also make private sector lending less appealing due to higher perceived risks.

Need for Moderation

Dr. Muda Yusuf, CEO of the Centre for the Promotion of Private Enterprise (CPPE), emphasized the need for moderation in borrowing to avoid overheating the economy. He pointed out that borrowing, when financed through bonds and treasury bills rather than money printing, is less inflationary but can still crowd out private sector credit.

In summary, while the government’s borrowing strategy may support fiscal policy by funding the national budget, it poses significant risks to economic stability, requiring careful management to avoid adverse effects on inflation, private sector growth, and overall economic health.

News

Nigeria Police Shield Crypto Scammer Jesam Michael

Imagine losing millions to a promise of guaranteed returns, only to find the system stacked against you. This is the harsh reality for investors in Afriq Arbitrage System (AAS), led by Jesam Michael, who now faces allegations of defrauding investors of $87.6 million.

The case took a troubling turn when the Nigerian police, supported by the Special Investigation Unit (SIU), detained individuals accused of cyberbullying Michael. This raises questions about the fairness of the investigation and the protection of victims’ rights.

The Inspector General of Police (IGP) and the Nigeria Immigration Service were involved in the arrests, sparking concerns about the impartiality of law enforcement in this matter. As the investigation unfolds, one thing is clear: the need for transparency and justice for all parties involved.

Background of the Case and Police High Command Compromise

The case involving Jesam Michael and the Afriq Arbitrage System (AAS) has brought to light serious concerns about the integrity of Nigeria’s law enforcement. Reports from SaharaReporters indicate that high-ranking police officials may have been compromised, potentially shielding Michael from scrutiny.

Overview of the Police Hierarchy Involvement

The Nigerian police structure is hierarchical, with the Inspector General of Police (IGP) at the top. The Special Investigation Unit (SIU) operates under this hierarchy, tasked with handling complex cases. However, in this case, the SIU’s involvement has raised eyebrows due to allegations of bias.

The Nigeria Immigration Service has also been implicated, with their role in detaining individuals accused of cyberbullying Michael. This has led to questions about the fairness and impartiality of the investigation.

Timeline of Key Events

The timeline begins with Michael reporting a fraud claim to the IGP, alleging he was defrauded of $87 million by Abayomi Segun Oluwasesan. This led to a series of events, including the detention of individuals critical of Michael.

By February, the investigation was underway, but the police high command’s actions have been called into question. The SIU’s role has been particularly scrutinized, with concerns about whether the unit acted independently or was influenced by external factors.

The involvement of the Nigeria Immigration Service adds another layer to the case, suggesting a coordinated effort that may have delayed investor fund withdrawals. As the situation unfolds, transparency and accountability remain critical to ensuring justice for all parties involved.

Detailed Account of Jesam Michael’s Arrest

The arrest of Jesam Michael unfolded through a coordinated operation involving the Nigeria Immigration Service and the Special Investigation Unit (SIU) under the Inspector General of Police (IGP). This case has drawn significant attention due to its complexity and the allegations of fraud tied to the Afriq Arbitrage System (AAS).

Role of the Nigeria Immigration Service and SIU

The Nigeria Immigration Service played a key role in apprehending Jesam Michael, collaborating closely with the SIU. Their joint efforts were instrumental in executing the arrest, showcasing a structured approach to handling high-profile cases.

The SIU provided critical support during the operation, ensuring that the legal framework was followed meticulously. Their involvement underscored the seriousness of the allegations against Michael.

Investigation and Arrest Timeline

The investigation began when Jesam Michael reported being defrauded of $87 million to the IGP. This led to a thorough probe, revealing discrepancies in asset transfers and a lack of legitimate trading evidence.

By February, the SIU had gathered sufficient evidence to proceed with the arrest. The timeline highlights the meticulous planning and coordination between the SIU and the Nigeria Immigration Service.

The case revealed that Michael had transferred recovered funds into his personal name, raising concerns about the management of investor assets. These findings have added layers to the legal proceedings, emphasizing the need for transparency.

How Nigeria Police Protected Nigeria’s Cryptocurrenc Criminals, Jesam Michael

The case of Jesam Michael, CEO of the Afriq Arbitrage System (AAS), has exposed deep concerns about the Nigerian police’s role in shielding suspects. Reports from SaharaReporters reveal that high-ranking officials acted swiftly to secure Michael’s release after his arrest.

The police hierarchy employed specific tactics to protect Michael. They detained individuals accused of cyberbullying linked to him, a move that supported his narrative. This approach not only raised questions about the fairness of the investigation but also weakened public confidence in the police command.

Evidence suggests that the detained individuals were released prematurely, further undermining the investigation’s credibility. This shielding has significant implications for investor safety and the integrity of future probes.

These actions highlight systemic issues within the police force, where protecting certain individuals seems to take precedence over justice. The lack of transparency and accountability raises concerns about the fairness of Nigeria’s legal system.

Analysis of Financial Exploitation and Fraud Tactics

The case of Jesam Michael and the Afriq Arbitrage System (AAS) reveals a complex web of financial exploitation. Investors were lured with promises of high returns, only to find their funds locked for over 18 months. This mirrors tactics used by Michael’s previous venture in the US, which was shut down for operating a Ponzi scheme.

Documents from the State of California highlight how referral programs were used to recruit investors, resembling pyramid schemes. These programs incentivized existing investors to bring in new ones, creating a false sense of legitimacy. The lack of credible trading evidence and a clear repayment plan further raises red flags about the operation’s legitimacy.

| Country | Fraudulent Tactics | Outcome |

|---|---|---|

| Nigeria | High-return promises, referral programs | Funds withheld for over 18 months |

| USA | Ponzi scheme operations | Shutdown by California authorities |

The investigation uncovered that funds were transferred into Michael’s personal accounts, adding to the suspicion of fraud. This case underscores the need for stricter regulations and investor protections in both countries.

Impact on Investors and Associated Victims

The case of Jesam Michael has left countless investors in financial ruin. Many have been unable to recover their principal funds or receive promised returns for over 18 months. This prolonged withdrawal issue has caused severe financial strain and emotional distress.

The situation worsened when several individuals were arrested for cyberbullying linked to Michael. These arrests not only added to the social stigma but also raised concerns about the fairness of the investigation. Victims felt their voices were being silenced, further complicating their quest for justice.

The police’s actions, including detaining critics, have drawn criticism. This perceived bias has deepened the suffering of victims, who already feel betrayed by the system. The lack of transparency in the investigation has eroded trust in law enforcement and the financial systems they are supposed to protect.

| Country | Fraudulent Tactics | Outcome |

|---|---|---|

| Nigeria | High-return promises, referral programs | Funds withheld for over 18 months |

| USA | Ponzi scheme operations | Shutdown by California authorities |

This case underscores the broader implications for investor trust in crypto trading. The lack of accountability and transparency has left many questioning the integrity of financial systems. As the situation unfolds, it’s clear that systemic changes are needed to protect investors and ensure justice.

Conclusion

The case of Jesam Michael has unveiled significant flaws in Nigeria’s law enforcement system, particularly in how high-profile individuals are handled. Victims of financial fraud have faced prolonged delays in recovering their investments, leading to widespread distrust in the system.

The Special Investigation Unit (SIU) and the Nigeria Immigration Service played pivotal roles in Michael’s arrest. However, the transparency of these actions has been questioned, raising concerns about impartiality and the influence of external factors.

The impact on investors has been devastating, with many facing financial ruin and emotional distress. The detention of critics linked to Michael further complicated the situation, silencing voices and deepening suffering.

Systemic issues within the police force have undermined public confidence. The need for greater accountability and transparency is evident to restore trust in both law enforcement and financial systems.

As this case continues to unfold, it is imperative to demand reforms and greater scrutiny of such investigations. Only through systemic change can justice and investor protection be ensured.

News

Marc Fogel Released from Russian Detainment

Thinking about Marc Fogel’s journey, we’re filled with relief. After over three years of waiting and fighting, he’s free. This isn’t just about one man’s fight for freedom. It’s a story about strong bonds and never losing hope that brings us all together. Fogel’s comeback is key for his loved ones who fought for his release during tough times.

His return to the U.S. shows how thankful he is for the support. It’s a victory for everyone who backed him. Reflecting on this, let’s remember how important it is to stick together through hard times. These are moments we shouldn’t forget as we fight for justice and peace. We hope Fogel’s release brings a positive change in our dealings with other countries and in protecting our freedoms.

Background on Marc Fogel’s Detention

Marc Fogel’s time in a Russian jail highlights wrongful imprisonment talks. In August 2021, he was caught with 17 grams of cannabis at a Moscow airport. The cannabis was for medical use, prescribed by a U.S. doctor. Still, he faced serious charges. By June 2022, Fogel was sentenced to 14 years in a penal colony for “large-scale drug smuggling.” His case drew global attention, especially regarding how foreign detainees are treated.

While detained, Fogel spent around 1,278 days under tough conditions. He was hospitalized for over 100 days and received more than 400 injections, showing his health problems. In December 2024, the U.S. labeled him as “wrongfully detained.” This highlighted growing worries about his wellbeing. Before his release, the Senate pushed for action with a bipartisan resolution, highlighting efforts to free him.

Marc Fogel’s ordeal is central to discussions on U.S.-Russia relations and foreign legal treatment. As his situation was updated, it underscored talks on human rights and diplomacy. The push to get Fogel released from Russia shows hope amidst turmoil for many Americans in similar predicaments.

The Arrest: What Happened to Marc Fogel?

On August 15, 2021, Marc Fogel experienced a major change in his life. He was arrested by Russian authorities at Sheremetyevo International Airport. They found about 17 grams of cannabis on him and detained him for drug trafficking.

His family claimed the cannabis was for medical use to help with his severe spinal pain. However, the Russian legal system convicted him in June 2022, not accepting the medical use defense.

Fogel was then sentenced to 14 years in prison. This punishment is seen as excessive by many, especially when compared to other, more publicized cases like Brittney Griner’s. Despite this, the marc fogel russia incident didn’t get much attention.

As of September 2023, a Change.org petition for Fogel’s release had 22,455 signatures. It’s close to its 25,000-signature goal.

Marc Fogel’s case was later declared a wrongful detention, indicating a major issue with how American citizens are treated overseas. Finally, after almost 3 years and 7 months, U.S. Secretary of State Marco Rubio announced Fogel’s release date. It will be on February 11, 2025. Fogel’s 95-year-old mother eagerly awaits his return.

Condemned for Cannabis: The Legal Charges against Fogel

Marc Fogel’s story is a tough one, happening in Russia. He faced charges of “large-scale drugs smuggling” for having medical cannabis. This was against Russian law. This charge shows how strict Russia’s legal system is. It also brings up issues about how foreigners are treated there.

His lawyers said the cannabis was for medical purposes. This sparked a lot of debate about global drug laws. Because of the marc fogel legal charges, he got a 14-year sentence. This harsh punishment shows the serious risks for an american detained in russia.

Fogel got out after about two years, though. His story is important beyond just what happened to him. It points out how tough it is for Americans caught under harsh drug laws abroad. This is especially true in places like Russia where politics are tense.

Global Reaction to Marc Fogel’s Detention

The world was deeply concerned about Marc Fogel’s arrest. Since August 2021, people talked more about the unfair sentence he got. In June 2022, he was found guilty of smuggling a large amount of drugs. He got 14 years for having about 17 grams of cannabis, which was for his pain.

Many groups advocating for human rights said his punishment was too harsh. Later, in December 2024, the U.S. government said he was wrongfully held. During his time in captivity, many public figures and lawmakers demanded his freedom. This case made many talk about the tough relations between countries. On social media, lots of people wanted a marc fogel freedom announcement.

When Fogel was finally released on a Tuesday, the world paid close attention. This release was seen as a key moment between the U.S. and Russia. It showed what could happen in the future for other Americans held there. Looking back, we see how Fogel’s release will influence international talks for years.

| Incident | Data |

|---|---|

| Detained since | August 2021 |

| Conviction date | June 2022 |

| Sentence length | 14 years |

| Designation as wrongfully detained | December 2024 |

| Comparison to Brittney Griner | 9-year sentence |

| Mother’s age | 95 years old |

U.S. Government’s Response to Fogel’s Situation

Marc Fogel’s arrest in Russia in August 2021 shows a tough diplomatic situation. At first, the U.S. hesitated to call him wrongfully detained. By December 2021, the Biden administration changed its stance, helping to push for his freedom. Meanwhile, Fogel’s health got worse in jail, leading his family to ask for help from U.S. leaders.

The situation became more urgent, drawing attention from Congress. Lawmakers sent letters to the State Department, asking for Fogel’s release because of his health. Pressure on the U.S. government grew as news about Fogel spread.

In August 2023, a big prisoner swap happened, highlighting Evan Gershkovich’s release. Talks about freeing Fogel gained momentum, even though the details were kept secret. President Trump hinted that the negotiation didn’t cost the U.S. much, sparking more curiosity about Fogel’s release.

The situation around Marc Fogel highlighted the tough political issues tied to the Russia-Ukraine conflict. The Biden administration’s actions showed they understood the need to support detained Americans. This shift helped move towards solving Fogel’s case.

Negotiations Leading to Marc Fogel’s Release

The story of Marc Fogel’s release has caught the world’s eye. It happened thanks to hard work by Donald Trump and Special Envoy Steve Witkoff. Steve Witkoff’s trip to Russia was a key moment, especially with current tensions.

Fogel was in Russian custody for over three years, detained in August 2021. He faced a 14-year sentence for a small drug offense. By December 2024, the U.S. called him “unjustly detained,” pushing harder for his freedom.

The talks happened amid tough times, including an attack on President Trump. Secretary Marco Rubio highlighted the many Americans still detained in Russia. This underscores the diplomatic hurdles that persist.

Fogel’s release brought joy to his loved ones, ending a long period of worry. The deals made showed the tricky give-and-take between the U.S. and Russia. They were affected by the conflict in Ukraine too.

| Key Events | Date | Details |

|---|---|---|

| Marc Fogel’s Detention Begins | August 2021 | Fogel detained in Russia on drug charges. |

| Designation as Unjustly Detained | December 2024 | U.S. State Department classifies Fogel’s status. |

| Negotiations by Steve Witkoff | July 2023 | First senior U.S. official to visit Russia in years. |

| Fogel’s Release | July 2023 | Marc Fogel released after extensive negotiations. |

| Potential Assassination Attempt on Trump | July 13, 2024 | Relevant discussions during Fogel’s negotiation process. |

Marc Fogel’s release marks a pivotal moment in U.S.-Russia relations. It also shines a light on the plight of Americans detained overseas. Reflecting on his release, we see the critical need for ongoing talks between countries.

Marc Fogel, American detained in Russia released: The Details Unfold

Marc Fogel’s release is a key moment for U.S.-Russia relations. He was freed on February 11, 2025, after a long stay in Russia. His return highlights years of legal work and talks about his case.

The story of his release shows how complex diplomatic talks can be. He got 14 years in jail for having cannabis. When the U.S. said he was detained wrongfully in December 2024, people paid more attention.

This attention came after the case of Brittney Griner, a big basketball name in the U.S., who faced a similar situation. Griner’s swap set the stage for Fogel’s freedom.

Talks about letting Fogel go were shaky but successful. These discussions let an American come home despite tough U.S.-Russia relations. The work by the Biden team to free Americans before this aided Fogel’s case.

Fogel’s emotional return to Joint Base Andrews showed huge support from everyone. He met Donald Trump, marking a happy end to his challenging time. This story touches many who followed his tough journey. It’s about never giving up and the hard work of diplomacy.

| Detail | Information |

|---|---|

| Sentence Length | 14 years |

| Arrest Date | 2021 |

| Status of Detention | Wrongfully Detained |

| Release Date | February 11, 2025 |

| Notable Meetings | Meeting with President Trump |

| Historical Context | Largest exchange since Cold War |

Trump’s Role in the Release of Marc Fogel

President Donald Trump played a vital role in pushing for the trump marc fogel release. He led talks that were quite extraordinary. These were aimed at bettering the relationship with Russia. Trump and his team often spoke about the need to free Americans held overseas without reason.

Marc Fogel’s release came from a tough situation. Since 2021, he had been held for having a bit of medical marijuana. The U.S. saw him as unjustly held. Trump said the talks showed Russia’s willingness to work together on hard issues.

The efforts to free Fogel moved quickly with Trump’s team. This quick action stood out when compared to past efforts that took longer. It happened even as tensions were high, mainly due to Russia stepping into Ukraine. Yet, helping Americans in detainment stayed as the top concern.

When news broke of Fogel’s freedom, it gave hope to many families in similar binds. They felt thankful and hopeful. Trump’s part in this made Fogel’s case known. It also put a spotlight on the fight to free other detained Americans.

Family’s Reaction to Marc Fogel’s Return

Feeling an immense wave of relief, we welcomed Marc Fogel back after his long, tough ordeal. His family, including our 95-year-old mother, fought tirelessly for his freedom during his three-plus years in Russian detainment. We thank everyone who helped free him. With each step towards his release, hope grew within us.

This journey took a huge emotional toll on us. We’ve called it “the darkest and most painful period of our lives.” His sister was overjoyed, having waited so eagerly for this moment. Though the road was tough, the news of his freedom brought us joy and relief.

On February 11, 2025, Marc’s return made us incredibly thankful for all the support. His case highlights broader U.S.-Russia relations issues. It also opens a new hopeful chapter for others still detained in Russia. Our family is united in happiness, looking forward to better days.

Health Concerns Faced by Marc Fogel during Detainment

Marc Fogel faced serious health issues while detained in Russia. His family and supporters were alarmed as his health got worse. He spent over 100 days in hospitals for major medical care.

Fogel’s health suffered under tough prison conditions. His chronic back pain and age made his long detention even more harmful. This situation led to calls for his release on humanitarian grounds.

Legal experts noted that people caught with small amounts of cannabis usually get lighter sentences. Fogel’s 14-year sentence was criticized as being too harsh and politically driven.

There’s more awareness now about Marc Fogel’s case, as he’s recognized as wrongfully detained, like Brittney Griner. Efforts to highlight his health issues make us hopeful for his recovery after release.

| Health Status | Details |

|---|---|

| Length of Detainment | Over 3 years |

| Hospitalization | More than 100 days |

| Medical Issues | Chronic back pain, severe stress |

| Family Concerns | “A death sentence due to his age and health” |

| Legal Status | Designated as wrongfully detained |

Potential Impact of Fogel’s Release on U.S.-Russia Relations

Marc Fogel is back in the U.S. after over three years in Russian detention. His case shows the tough talks needed for detained Americans, amidst tensions. It mixes humanitarian worries with national security.

Though seen as wrongfully held, Fogel’s freedom might open new talks. Experts think this event could lead to better U.S.-Russia discussions. It suggests a new approach to dealing with detained Americans.

Fogel was released during a tense time in U.S.-Russia relations, with the Ukraine war in the background. The White House saw his release as a peace gesture from Russia. Yet, it makes us wonder about future talks. Fogel’s case is now linked with other detained Americans, pushing the U.S. to act for them too.

Fogel being free is good news for his family and supporters. But it’s unclear how this will affect U.S.-Russia ties. Fogel’s story could be key in future diplomacy about detained Americans and wider talks.

Reactions from Political Leaders and Public Figures

Leaders from both parties expressed joy over Marc Fogel’s freedom. They highlighted it as a win for human rights. Figures from various fields also noted Fogel’s release as a key victory. It symbolizes hope for Americans wrongfully detained abroad.

There’s a push for more diplomatic work to free others in similar situations. The urgency is clear in ensuring Americans are safe overseas. This moment boosts the dialogue on U.S.-Russia relations, pointing towards future collaboration.

Lawmakers see Fogel’s return as a beacon of hope for American hostages. They value the diplomatic efforts that made it possible. This case reinforces our collective goal for justice and human rights everywhere. The release of Fogel sparks renewed calls for the freedom of others unjustly held.

Conclusion

Marc Fogel’s release from Russia is a big moment for him and his family. It shows us the bigger problems with Americans being held in other countries. He spent 1,255 days in a Russian jail, showing the tough issues in global diplomatic relations. His case reminds us to keep fighting for justice and human rights around the world.

Marc Fogel’s freedom shows how law, diplomacy, and caring about others play a role in U.S. foreign policy. The deal to bring him home was done in just 22 days, after he was locked up for over three years. His case sheds light on other Americans still in Russian prisons. This makes us think about how we must protect our citizens everywhere.

Fogel’s return is not just good news for him, but it also tells us to make sure justice wins everywhere. Looking ahead, his story will probably affect how we deal with Americans detained abroad and improve U.S.-Russia relations. Despite challenges, Fogel’s courage and his family’s fight show us the way to better talks and changes.

News

Maxwell Chikumbutso Innovates Self-Powered Car

We looked at busy streets filled with cars that use lots of gas. It made us hopeful. Maxwell Chikumbutso’s self-powered car brought a wave of curiosity and hope. Could this car change how we use energy?

In Africa, dreams and hard truths often meet. Here, Chikumbutso stands out as a symbol of hope. He says his car needs no gas, no charging, and no help from outside sources. This story invites us to imagine a new way of dealing with energy.

Chikumbutso has 382 followers on social media. Despite doubts and challenges from big energy companies, his work is getting noticed. His story reminds us that courage can spark major changes. It paves the way for a cleaner, better future.

Introduction to Maxwell Chikumbutso’s Innovative Technology

In Zimbabwe, part of southern Africa, something amazing is happening. Renewable energy is taking a giant step forward, thanks to Maxwell Chikumbutso. He created a tiny device that turns radio waves into energy we can use. This could change how our cars work, giving them a never-ending energy source.

Maxwell Chikumbutso’s work means more than just new gadgets. It’s about building a future where we take energy from the air around us. This leap could lessen our need for oil and gas. It makes us think of new ways to get around without harming the planet.

The Concept Behind the Self-Powered Car

Maxwell Chikumbutso has brought forward a groundbreaking self-powered car technology. This could change how we think about cars. His method uses natural radio frequencies to generate energy, making us rethink vehicle power sources. Usually, cars need fuels or batteries, but Chikumbutso’s idea goes beyond that.

This car doesn’t need fuel or recharging, offering a new solution to energy use. It fits well with the push for clean energy. Even though some doubt its possible due to current science understanding, succeeding could change vehicles forever.

The Saith FEV car is Chikumbutso’s leading model, working as a fully self-powering electric vehicle. Some critics point out that parts of his energy devices seem similar to existing portable power stations. Yet, he keeps aiming to shake up the energy world with clean solutions.

The car industry is at a turning point. If Chikumbutso’s self-powered car tech succeeds, it might transform how we travel. It leads to a future where cars don’t depend on usual energy sources. Also, making clean energy a priority in cars is becoming more important, setting the stage for new sustainable innovations.

Maxwell Chikumbutso -Africa’s Self Powered Car SHOCKs the world

Maxwell Chikumbutso’s self-powered vehicle has started a global talk. It’s about Africa’s role in future car technology. The Saith FEV is pitched as a game-changing electric car that works on its own. It doesn’t need fuel or to be recharged. People are excited but also wonder if it’s possible.

But, there are doubts about how new the Saith FEV really is. It seems to be a changed version of another car, the Kaiyi X3 Pro EV. This news has made people question the truth behind its promotion. Also, people on social media are asking if its energy source really fits with science rules.

There’s more confusion with Chikumbutso’s other invention, a hypersonic energy device. It looks a lot like something you can buy for $109 since August 9, 2023. Scientists who checked out his inventions in Zimbabwe didn’t reach a clear verdict. This situation makes us question the uniqueness of his work.

In dealing with Maxwell Chikumbutso’s inventions, we see bigger questions. These are about how we find and use new ways to power our lives. It’s key to check deeply the tech claims we hear. Only through careful evaluation can we find real solutions for our planet.

Chikumbutso’s Revolutionary Energy Source

Maxwell Chikumbutso is changing the game with his energy idea. He uses radio frequencies to power his self-running car. This new method is a big leap from old ways of getting renewable energy. It shows us what future energy could look like. By using the energy around us, we have a way to make energy that could cut down on fossil fuels.

Radio Frequencies as a Power Source

Thinking of radio frequencies as a way to make power is a big change. Chikumbutso says his cars don’t need the usual fuel or charging stations. This could really change how we use energy. By making the most of radio waves, we’re stepping into a future where energy freedom is real. Cars running only on these frequencies might make carbon emissions much lower.

Implications for Future Energy Consumption

The impact on future energy use is huge. If Chikumbutso’s idea works, it could do more than just change how we get around. It could start a shift towards saving the environment. Cutting down on old energy types, we can push forward with eco-friendly energy technology. This might change not just transport but many areas. Making renewable energy common could lead us to a much greener future.

Development of the Saith Electric Vehicle

The Saith electric vehicle marks a big step forward in car innovation. We teamed up with manufacturers like the Chinese company KAIYI to make a car that blends new tech with real-world use. This project shows how working together across countries can push car design into the future.

Partnership with Chinese Manufacturers

Working with KAIYI was key to building the Saith electric car. They supplied the body and vital parts. With their help, we made a car that looks good and works great. This partnership is a great example of teamwork in making electric cars better.

Technical Specifications and Features

The Maxwell Chikumbutso electric vehicle has some standout specs that make it unique. Here are the main features:

| Feature | Description |

|---|---|

| Driving Range | Unlimited thanks to innovative power management |

| Top Speed | 220 km/h |

| Self-Parking | Equipped with a self-parking vehicle functionality for enhanced convenience |

| Driving System | Advanced driving system ensuring smooth operation and safety |

| Production Cost | Estimated at US$14,000 per unit |

We dream of a self-parking car that uses advanced systems, mixing top-notch tech with a cost-effective production method. The Saith shows our promise to change transport with new ideas.

The Launch Date and Global Interest

The launch date for Maxwell Chikumbutso’s Saith electric vehicle is set for February 10, 2025. This marks a big moment in the car industry, creating excitement in the media. As we get closer to the launch, there’s growing global interest in Chikumbutso’s new technology.

Scientists, engineers, and investors from all over are excited for the event. They want to see the Saith electric vehicle’s features. This interest shows how much research is being done on Maxwell Chikumbutso’s work. It represents hope for a self-powered car and sustainable transport.

| Launch Date | Event | Key Participants | Expected Impact |

|---|---|---|---|

| February 10, 2025 | Unveiling of Saith Electric Vehicle | Scientists, Engineers, Investors | Revolutionizing Sustainable Transportation |

The global excitement for the Saith electric vehicle is about more than just a new car. It signals a move toward sustainable solutions. This is important not only for an inventor but for everyone, aiming for a greener future.

Challenges and Skepticism Regarding the Invention

Maxwell Chikumbutso’s self-powered car has all eyes on it, but not without doubt. Some question if the technology really works as claimed. Checking these revolutionary ideas thoroughly is crucial. Without proof, people might end up disappointed.

Scientific Scrutiny and Claims of Skepticism

Chikumbutso’s idea has many scientists raising their eyebrows. His claims need more detail before the science world accepts them. Enthusiastic support doesn’t replace careful checking. Critics say we need a deep dive to prove his car can really do what he says.

Debunking Myths and Misconceptions

We need to clear up myths about Chikumbutso’s car amid the buzz. Simplifying the tech has led to false info. Claims about his invention’s uniqueness and how it works have often fallen short under scrutiny. Promoting serious questioning helps keep the focus on real renewable energy progress.

The Role of the Zimbabwean Government in Supporting Innovation

The Zimbabwean government is now focusing on helping local talents. Maxwell Chikumbutso is one such talent getting noticed. He is working hard to make Zimbabwe known for sustainable energy. He created the Saith FEV car and other unique ideas that have caught the government’s attention.

With the government’s support, these innovations could get the boost they need. There are talks about setting up a car manufacturing plant in Zimbabwe. This could help the economy and promote local talent. It shows the government’s commitment to new technology. It also might make Zimbabwe a leader in sustainable energy solutions.

Working with the government and innovators needs careful balance. We must stay open and honest to avoid doubt and negative claims. Keeping a transparent relationship can help prove the worth of local inventions. This is vital when facing doubts about the validity of inventors’ claims, like those made by Chikumbutso.

| Aspect | Details |

|---|---|

| Innovator | Maxwell Chikumbutso |

| Government Action | Support for local innovation through potential manufacturing initiatives |

| Focus Areas | Sustainable energy and technology advancement |

| Goals of Support | Boost local economy, enhance credibility in innovation |

Looking ahead, the partnership between the government and innovators is key. It can lead to major advancements in transportation and energy in the area.

Potential Impact on Sustainable Transportation Solutions

The arrival of Maxwell Chikumbutso’s self-powered car is very exciting. It introduces a big chance for us to become more eco-friendly. This vehicle uses advanced technology to cut our use of fossil fuels.

This car’s impact could be huge, helping to lower harmful greenhouse gases. By using these new energy solutions, we might inspire others. Communities and industries could start using greener options too.

We’re eager to see how this innovation changes cities and public transport. Self-powered cars offer more than a simple benefit to us; they show our dedication to protecting our planet.

| Aspect | Current System | With Self-Powered Cars |

|---|---|---|

| Energy Source | Fossil Fuels | Renewable Energy |

| Carbon Emissions | High | Significantly Reduced |

| Environmental Impact | Pollution | Cleaner Air |

| Cost Efficiency | Rising Costs | Decreased Fuel Costs |

| Public Awareness | Low | Increased Education |

In conclusion, looking into green transport methods is key. Innovations like these are crucial for a healthier planet. They stress the urgent need for us to find and adopt solutions fast.

The Vision for a Clean Energy Future

Maxwell Chikumbutso’s work is changing how we view transportation. His self-powered car is not just a cool invention. It’s a big step towards a future with cleaner, sustainable energy. His ideas help us move away from old energy forms to new, cleaner ones. This will make the future brighter for everyone.

Reducing Dependence on Fossil Fuels

It’s crucial we use less fossil fuels now more than ever. These fuels pump a lot of carbon into the air, worsening climate change. With Maxwell Chikumbutso’s new energy for vehicles, we’re moving to sustainable travel. Using renewable energy helps us all lower our impact on the planet.

Chikumbutso’s ideas show we can be energy independent. Promoting clean tech means big changes in how we use energy. His forward thinking matches global moves and gives hope to the next generation. They aim for a world that’s healthy for everyone.

| Factor | Traditional Energy Sources | Maxwell Chikumbutso Energy |

|---|---|---|

| CO2 Emissions | High | Minimal |

| Environmental Impact | Significant | Negligible |

| Resource Dependence | Fossil Fuels | Renewable Sources |

| Cost Efficiency | High | Low |

This table shows big differences between old and new energy sources. By moving towards clean energy, we’re working on a better future. We’re dedicated to making our communities and the world a more sustainable place.

Reactions from the Scientific Community

The thoughts on Maxwell Chikumbutso’s self-powered car within the science world are mixed and strong. Some top researchers see his ideas as revolutionary, potentially changing how we think about energy. However, others are cautious, insisting on solid proof and openness before fully supporting these bold claims.

Peer-reviewed studies are crucial for backing up Chikumbutso’s big breakthrough. There’s a clear call for thorough checks on innovations like this self-powered car. Only with enough proof can these new ideas gain acceptance, showing how careful optimism and critical questioning go hand in hand in science.

Conclusion

Reflecting on Maxwell Chikumbutso’s journey shows us how critical the idea of a self-powered car is. His idea of a car that never needs charging could change how we think about cars and energy. But, there’s a big gap between what we can harvest now and what his car needs.

The idea of self-powered cars brings both excitement and doubt. People love the idea of endless, clean energy. Yet, history tells us that free energy claims face big hurdles. The idea of making more energy than you start with is attractive. But it lacks solid scientific support. So, we need to be careful and thoughtful about these new ideas.

How we see innovation in transportation is changing. Chikumbutso’s vision adds to this change. It’s important to check his claims with actual data. Doing this will help decide if his car can really put Zimbabwe ahead in energy technology.